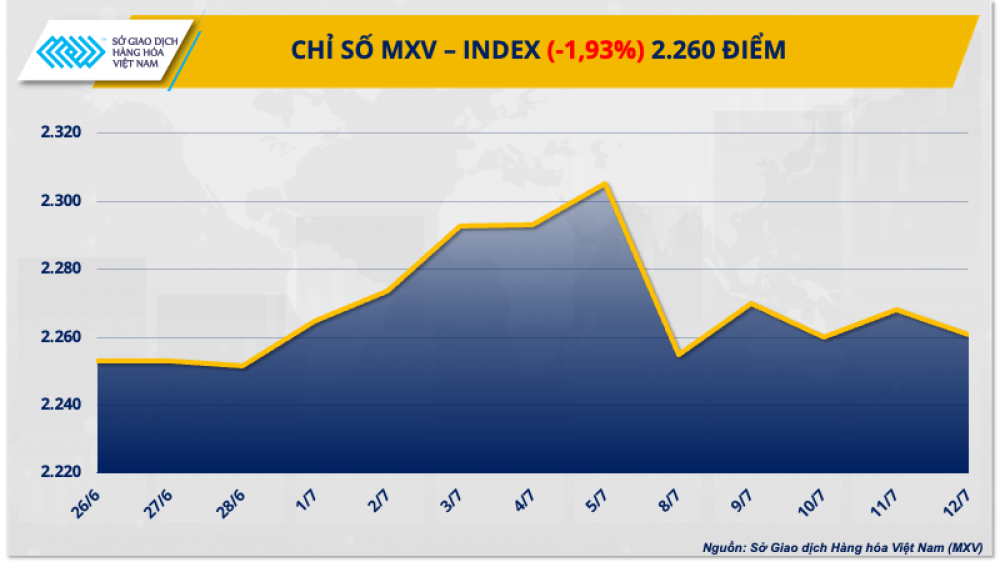

The Commodity Exchange of Vietnam (MXV) said that the world commodity market has just experienced a volatile trading week. Closing the trading week of 8-14/7, the prices of 3/4 commodity groups (except industrial materials) all declined, dragging the MXV-Index down 1.93% to 2,260 points.

The agricultural product market is facing great buying pressure, the commodity price index of this group suddenly plunged by 5.2% in the past week. Being among the only commodity groups to increase in price, Robusta coffee and Arabica coffee also have many notable developments. In particular, on July 9, the price of Robusta coffee climbed to a record high in history when it increased by nearly 600 USD compared to the beginning of July 2024.

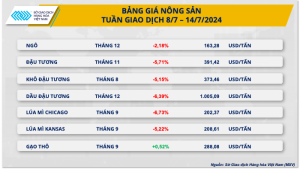

Agricultural product prices fell sharply

At the end of the trading session last weekend (14/7), the prices of 6/7 agricultural products (except raw rice) simultaneously fell by 5-6%. In which, corn is the commodity with the lowest weakening momentum. After a sharp plunge in the first session of the week, the corn market has fluctuated and recovered, especially after the surprising data in the July World Agricultural Supply and Demand Report (WASDE) of the US Department of Agriculture (USDA).

In this report, the USDA raised the forecast for the 2024-2025 US corn crop to 15.1 billion bushels, a negligible difference from market expectations. However, unexpectedly, the inventory of the 2024-2025 crop year was revised down to 2.09 billion bushels, contrary to analysts’ expectations of an increase and below the predicted range. The reason for this adjustment is that exports and consumption for the 2023-2024 crop year were raised compared to the previous report, pushing the inventory at the beginning of the 2024-2025 crop year to drop sharply. This factor caused corn prices to soar over the weekend and narrowed the previous decline.

On the other hand, last week, the weather in the US changed for the better. The remnants of Hurricane Beryl brought rain to the Eastern Corn Belt, especially Illinois and Indiana, which are already quite dry. In its Crop Progress report, the USDA said that the percentage of corn of good quality and excellent quality increased to 68% last week, from 67% the previous week and far exceeded the 50% in the same period last year. This shows that the crop outlook in the US is still relatively positive, putting prices under pressure.

In the domestic market, recorded at the end of the past week, the price of South American corn imported to our country’s ports tended to decrease slightly compared to the beginning of the week. At Cai Lan port, Nam My corn delivery in the last three months of this year is at 6,400 VND/kg. The asking price of imported corn at Vung Tau port is 100 VND/kg lower than the transaction price at Cai Lan port.

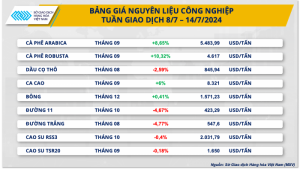

Volatile trading, coffee prices continue to create new historical peaks

According to MXV’s records, at the end of the last trading week, the price of Robusta coffee rebounded by more than 10%, establishing a new historical high at 4,617 USD/ton. Arabica coffee prices rose for the third week in a row, bringing the current trading price to its highest level in more than two years. Limited coffee supply in leading producing countries and weakening exchange rates have supported prices to rise.

In Vietnam, according to the General Department of Customs, in June, the volume of coffee exports was only nearly half of the same period last year, down 11.5% compared to the previous month. Generally, in the first half of this year, export volume also decreased by 11.4% over the same period in 2023. In addition, the market continues to be pessimistic about the prospect of new coffee supply in Vietnam. Forecasts from domestic and foreign organizations all show that our country’s coffee production in the 2024-2025 crop will decrease by 15-20% compared to the current crop. Low production will lead to a decline in export activities, and at the same time exacerbate the supply shortage in the market.

Many experts said that the source is also gradually scarce, and export activities will gradually decrease month by month. Even our country’s coffee exports have only improved since the end of the year when the new crop is harvested.

Similarly, in Brazil, the Association of Coffee Exporters of this country (CECAFE) forecasts that Robusta coffee production may fall by 10% compared to the initial estimate, while Arabica coffee production may fall by 5%. In addition, the Dollar Index has just fallen for the second week in a row after the US CPI was announced, leading the USD/BRL exchange rate to lose 0.56%. The narrowing of the exchange rate difference somewhat restricts Brazilian farmers from selling coffee, which in turn also pushes prices up.

Source: Vietnam Commodity Exchange (MXV)